Taxes play a vital role in funding government programs and services, but they can often be a source of confusion and frustration for many individuals. One common question that arises is, “How much tax is taken out of a specific amount, such as $1,200?” In this article, we will explore the different factors that influence the amount of tax deducted from $1,200 and provide a comprehensive understanding of tax deductions.

Understanding Tax Deductions

Before diving into the specific amount of tax that may be deducted from $1,200, it’s essential to comprehend the concept of tax deductions. Tax deductions are expenses or items that the tax code allows individuals to subtract from their taxable income, ultimately reducing the amount of tax owed. The deductions vary depending on the jurisdiction and the individual’s financial circumstances.

Factors Influencing Tax Deductions

Several factors can affect the amount of tax deducted from $1,200. The most significant factors include:

- Tax Bracket: Tax brackets determine the percentage of income that is subject to taxation. Different income levels are assigned to various tax brackets, each with its corresponding tax rate. Individuals falling into a higher tax bracket will have a higher percentage of their income taxed, potentially resulting in more significant deductions.

- Filing Status: Filing status, such as single, married filing jointly, or head of household, affects tax rates and deductions. Different statuses have different tax brackets, which can influence the amount of tax deducted from $1,200.

- Deductions and Credits: Deductions and credits are vital in determining the final tax liability. Common deductions include student loan interest, mortgage interest, and medical expenses. These deductions can reduce the taxable income, resulting in a lower tax burden.

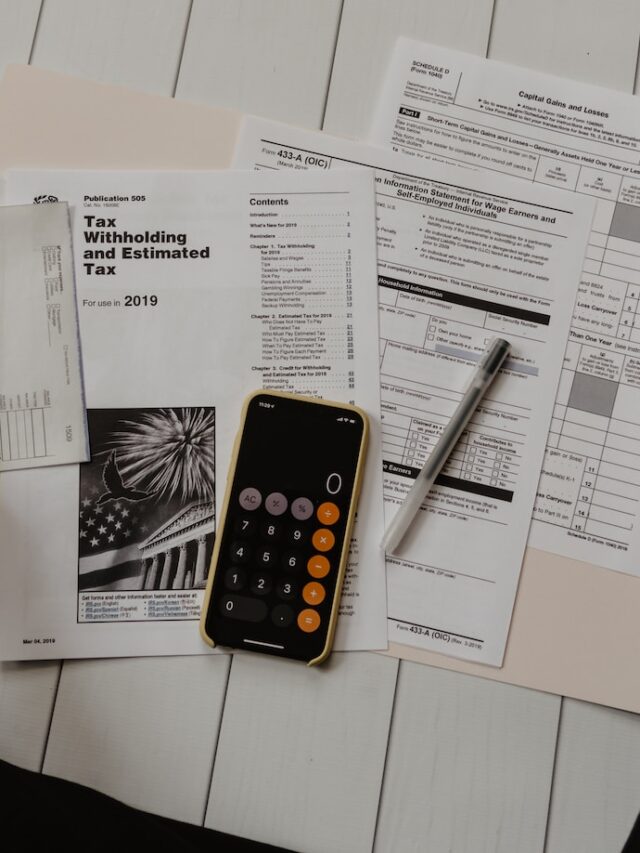

Calculation of Tax Deductions

To calculate the tax deductions on $1,200, we need to consider the specific tax laws and regulations in place. It is crucial to consult the tax laws of your jurisdiction or seek assistance from a tax professional for accurate information.

As an illustrative example, let’s assume a simplified scenario in which an individual falls into the 25% tax bracket. Considering this, 25% of $1,200 would be $300. However, this is a simplified calculation, and the actual deductions may vary based on various factors.

Conclusion

Understanding the amount of tax deducted from $1,200 requires an examination of several factors, including tax brackets, filing status, and deductions. While it is challenging to provide an exact amount without considering these factors, this article provides a general overview to help readers comprehend the key elements that influence tax deductions.

To accurately determine the amount of tax deducted from $1,200, it is recommended to consult the tax laws specific to your jurisdiction or seek guidance from a tax professional. They can assist you in assessing your unique financial situation and providing personalized advice.

Remember that taxation is a complex subject, and individual circumstances may vary significantly. Staying informed about tax laws and seeking professional assistance when needed can help ensure compliance and optimize your tax benefits.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or tax advice. Please consult a qualified tax professional for personalized guidance based on your specific situation.